depreciation rental property turbotax|turbotax rental property version : iloilo Same Property Rule: A regulation relating to IRA rollovers stipulating that whenever a financial asset is withdrawn from a retirement account or IRA (for the .

webG arotas que atendem 24 Horas em Santa Catarina. A plicativo GP Acompanhantes de Luxo com modelos famosas de Santa Catarina. V ocê terá acesso as Garotas de Santa Catarina e de todo o Brasil no GP Acompanhantes. N ovatas e C oroas, I niciantes e Experientes todo tipo de Mulher para o seu prazer disponíveis para atendimento com .

0 · which turbotax for rental property

1 · what turbotax do i need for rental property

2 · turbotax rental property version

3 · turbotax enter real estate depreciation

4 · turbotax 2023 for rental property

5 · calculating depreciation on rental property

6 · best turbotax for rental property

7 · allowable depreciation on rental property

8 · More

Resultado da 4 dias atrás · Izzy Bizu - White Tiger (Lyrics)Stream "White Tiger" by Izzy Bizu:Follow Izzy Bizu YouTube: @IzzyBizu .

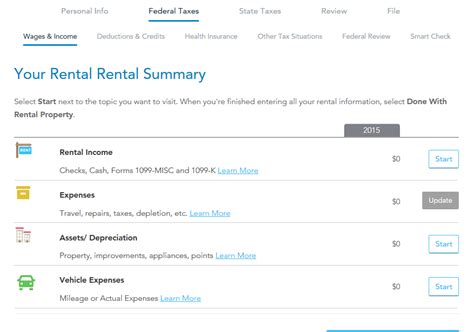

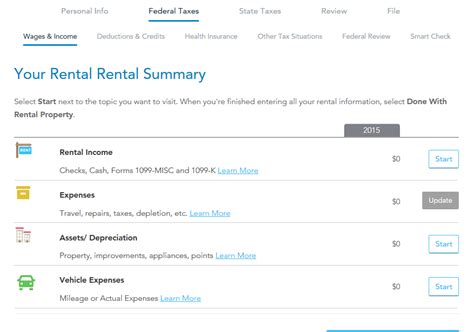

depreciation rental property turbotax*******In TurboTax Online, report depreciable assets under the rental activity. TurboTax software will determine the depreciation for each asset. Follow these steps: .To enter your rental improvements, simply follow the directions toenter your rental income and expenses. At some point you'll come across the Rental Summary screen. . To figure out the depreciation on your rental property: Determine your cost or other tax basis for the property. Allocate that cost to the different types of . On a 2021 PDF download there will be a Depreciation and Amortization Report, which will have the information for all the assets you entered for depreciation .

The sales contract showed that the building cost $160,000 and the land cost $25,000. Your basis for depreciation is its original cost, $160,000. This is the first year of service for your residential rental property and you .turbotax rental property version Same Property Rule: A regulation relating to IRA rollovers stipulating that whenever a financial asset is withdrawn from a retirement account or IRA (for the .

To calculate that amount, subtract the $92,290.91 in accumulated depreciation deductions you’ve claimed on your taxes from the original cost basis of $423,000 for a total of . 2 Best answer. tagteam. Level 15. Your depreciation, as well as other information about the rental, should have transferred in to your 2020 return (from your .depreciation rental property turbotax turbotax rental property version 2 Best answer. tagteam. Level 15. Your depreciation, as well as other information about the rental, should have transferred in to your 2020 return (from your .

TurboTax also can be used to report rental property depreciation and calculate capital gains tax liability when an investment property is sold. Rental property accounting .

Once you’ve entered all your info, you’ll be taken to the Your income and expenses screen. If you have more rentals to enter, scroll down to Rental Properties and Royalty Income (Sch E) and select Edit/Add next to this line. On the Your 2023 rentals and royalties summary screen, select Add another rental or royalty.

Rental. Review. Add Another Rental or Royalty (if needed) OR enter 2021 income and expenses. The yearly depreciation for 2021 is calculated from this information. Select Done when finished with 2021 income and expenses. Update Rental properties. Review. Select EDIT for the property. Scroll down to Assets/Depreciation.

depreciation rental property turbotax Depreciable basis: Generally, depreciation on your rental property is the based on the original cost of the rental asset less the value of the land (because land is not depreciable).The original cost can include various expenses related to the purchase of the property. If you make a capital improvement to the rental property, you will depreciate . Once you are in your tax return (for TurboTax Online sign-in, click Here ), click on the “Federal Taxes” tab ("Personal" tab in TurboTax Home & Business) Next click on “Wages & Income” ("Personal Income" in TurboTax Home & Business) Next click on “I’ll choose what I work on”.

2 Best answer. tagteam. Level 15. Your depreciation, as well as other information about the rental, should have transferred in to your 2020 return (from your 2019 return). If it did not, you can get the accumulated depreciation figure from the Depreciation and Amortization Report in your 2019 return package.

After personally living in a property for over 20 years, I converted it to a rental in 2019. When using TurboTax premier to do depreciation, I entered original cost, cost of land and date of purchase [1990's]. When asked for the date I started using it for business, I entered 2019. According to . Rental Improvements are depreciated using the same depreciation method as the Rental Property itself - straight-line over 27.5 years (asset type I - Residential rental real estate). When you enter the asset under Assets/Depreciation from the Rental Summary, TurboTax will calculate the allowable depreciation for this year and display .

In this video we demonstrate how to enter your rental property information into Turbo Tax, cover active participation in the real estate venture and show you. The tax code allows you to expense the cost of purchasing your rental property building and improvements (but not the land) over a number of years, through depreciation. This can provide you with a hefty annual expense to lower your taxable rental income each year. However, if you sell the property for more than the .

For example, if a rental property with a cost basis of $100,000 was first placed in service in June, the depreciation for the year would be $1,970: $100,000 cost basis x 1.970% = $1,970. In each of the following years, the depreciation expense would be $3,636.36: $100,000 x 3.636% = $3,636.36.Rental Property Tax Tips. Form 8582 is a tax document specifically designed to calculate how much passive activity loss can be claimed on your tax return in a given year. As with all businesses, the IRS requires you to report the income and expenses involved with running that business, including a farm rental.January 28, 2022 2:45 PM. You will need to amend your 2019 and 2020 returns to include the depreciation if you were renting it since you bought it. If you just started renting in 2021, there will be an entry that you can make to indicate when you bought it vs when you began renting it. January 28, 2022 2:54 PM.

Novinha de shortinho curto provocando o primo no barraco da favela. Teste de Fudelidade. 633.5K views. 02:20. Novinha gostosa rebolando de shortinho rosa. 14.8K views. 03:16. Novinha shortinho apertado. 24.7K views. 03:59. NOVINHA DANsANDO DE SHORTINHO. 3.8K views. 01:28. Novinha Bucetuda de Shortinho.

depreciation rental property turbotax|turbotax rental property version